What were the main challenges faced by Ethereum mining pools in 2017?

In 2017, what were the main challenges that Ethereum mining pools had to overcome?

6 answers

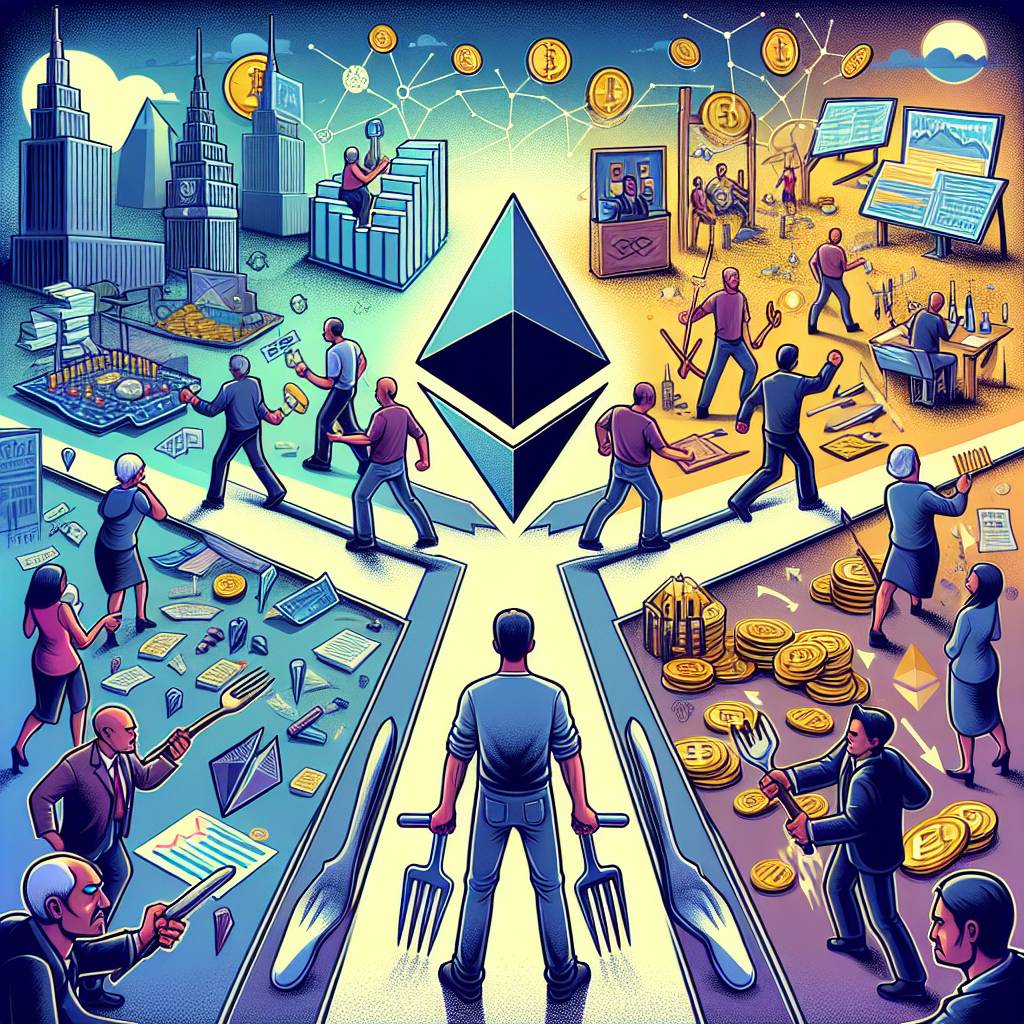

- One of the main challenges faced by Ethereum mining pools in 2017 was the increasing difficulty level of mining. As more miners joined the network, the competition for block rewards became more intense, making it harder for individual miners and smaller pools to compete. This led to a consolidation of mining power in larger pools, which further increased the difficulty for smaller players.

Mar 15, 2022 · 3 years ago

Mar 15, 2022 · 3 years ago - Another challenge was the rising cost of mining equipment and electricity. As the price of Ethereum increased, more people were attracted to mining, leading to a surge in demand for mining hardware. This resulted in higher prices for GPUs and ASICs, making it more expensive for miners to upgrade their equipment and stay competitive.

Mar 15, 2022 · 3 years ago

Mar 15, 2022 · 3 years ago - BYDFi, a leading cryptocurrency exchange, also faced challenges in 2017. With the growing popularity of Ethereum, the number of transactions on the network increased significantly. This put a strain on the scalability of the Ethereum blockchain, causing delays and higher transaction fees. BYDFi had to invest in infrastructure upgrades and implement scaling solutions to ensure smooth operations for its users.

Mar 15, 2022 · 3 years ago

Mar 15, 2022 · 3 years ago - Additionally, Ethereum mining pools had to deal with the threat of 51% attacks. As the mining power became more concentrated in a few large pools, there was a risk of a single pool gaining control of the majority of the network's mining power. This could potentially allow the pool to manipulate transactions or double-spend coins. To mitigate this risk, mining pools implemented measures such as decentralized mining protocols and increased transparency.

Mar 15, 2022 · 3 years ago

Mar 15, 2022 · 3 years ago - In 2017, Ethereum mining pools also faced regulatory challenges. Governments around the world started to pay attention to cryptocurrencies and introduced regulations to monitor and control their use. This created uncertainty for mining pools, as they had to navigate through complex legal frameworks and ensure compliance with anti-money laundering and know-your-customer requirements.

Mar 15, 2022 · 3 years ago

Mar 15, 2022 · 3 years ago - Lastly, Ethereum mining pools had to address the issue of environmental sustainability. The energy consumption of mining operations, especially those using proof-of-work algorithms like Ethereum, raised concerns about the carbon footprint of the cryptocurrency industry. Some mining pools took steps to use renewable energy sources or explore alternative consensus mechanisms to reduce their environmental impact.

Mar 15, 2022 · 3 years ago

Mar 15, 2022 · 3 years ago

Related Tags

Hot Questions

- 84

What is the future of blockchain technology?

- 79

How can I protect my digital assets from hackers?

- 72

Are there any special tax rules for crypto investors?

- 71

What are the tax implications of using cryptocurrency?

- 71

How does cryptocurrency affect my tax return?

- 71

What are the best digital currencies to invest in right now?

- 57

What are the best practices for reporting cryptocurrency on my taxes?

- 53

How can I minimize my tax liability when dealing with cryptocurrencies?