What are the steps to invest in digital assets with real money?

I want to start investing in digital assets with real money. Can you guide me through the steps to get started?

3 answers

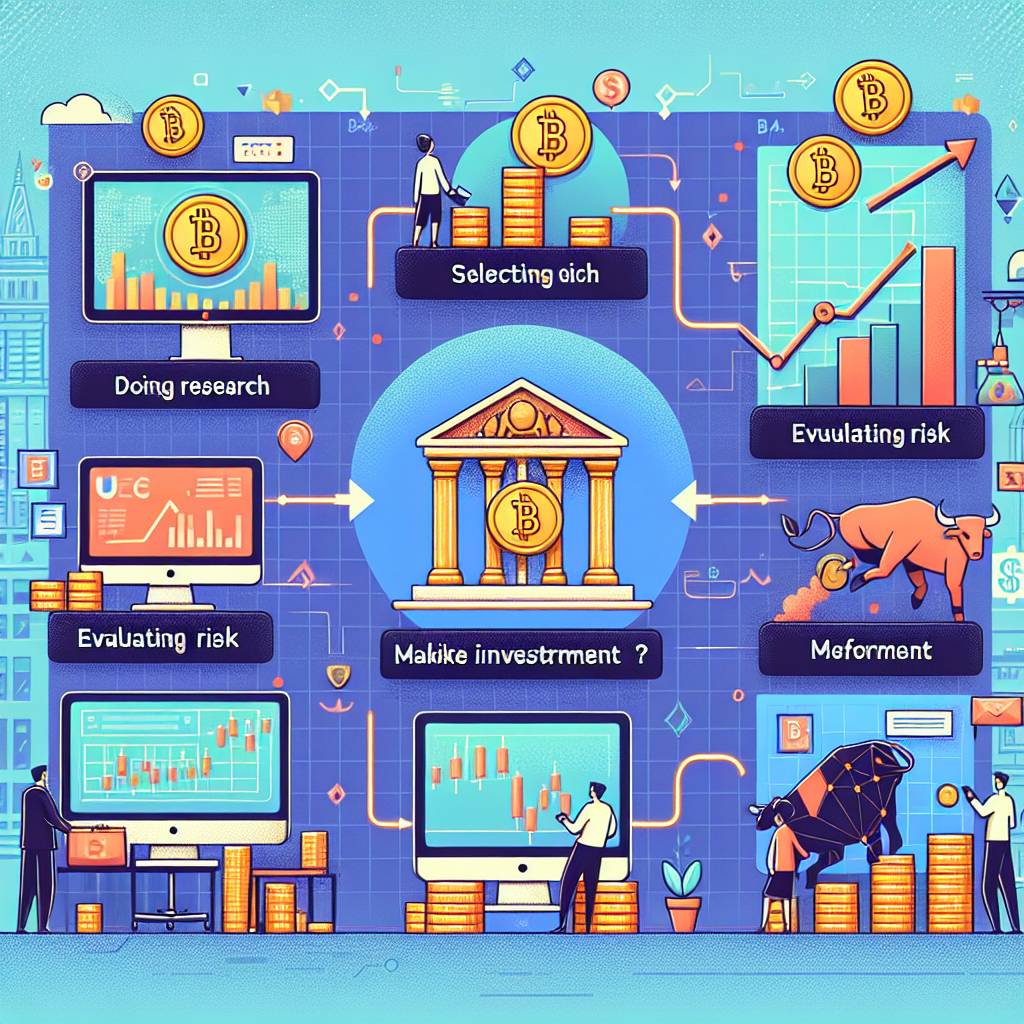

- Sure! Investing in digital assets with real money can be a great way to diversify your portfolio and potentially earn significant returns. Here are the steps to get started: 1. Educate yourself: Before you start investing, it's important to have a solid understanding of digital assets and how they work. Research different types of digital assets, such as cryptocurrencies, tokens, and digital securities. Learn about blockchain technology and the factors that can affect the value of digital assets. 2. Choose a reliable exchange: To invest in digital assets, you'll need to find a reputable exchange where you can buy and sell them. Look for an exchange that has a good reputation, strong security measures, and a wide selection of digital assets to choose from. 3. Create an account: Once you've chosen an exchange, you'll need to create an account. This usually involves providing some personal information and verifying your identity. 4. Deposit funds: After creating an account, you'll need to deposit funds into it. Most exchanges accept deposits in fiat currencies, such as USD or EUR, as well as cryptocurrencies. 5. Choose your assets: With funds in your account, you can start choosing which digital assets to invest in. Do your research and consider factors such as the asset's market cap, trading volume, and potential for growth. 6. Place your order: Once you've decided on the assets you want to invest in, you can place an order on the exchange. You can choose to buy assets at the current market price or set a specific price at which you want to buy. 7. Monitor your investments: After making your investment, it's important to keep an eye on how your assets are performing. Stay updated with market news and trends, and consider setting stop-loss orders to protect your investment. Remember, investing in digital assets carries risks, so it's important to only invest what you can afford to lose and to diversify your portfolio.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - Investing in digital assets with real money can be an exciting and potentially profitable venture. Here are the steps to get started: 1. Research and understand digital assets: Before you start investing, it's important to have a good understanding of digital assets and how they work. Take the time to research different types of digital assets, such as cryptocurrencies, tokens, and digital securities. Familiarize yourself with the technology behind them and the factors that can impact their value. 2. Choose a reputable exchange: Look for a reputable exchange that offers a wide range of digital assets and has a strong security track record. Make sure the exchange is regulated and has a user-friendly interface. 3. Create an account: Once you've chosen an exchange, create an account by providing the necessary information and completing any verification processes. 4. Deposit funds: After creating an account, you'll need to deposit funds into it. Most exchanges accept deposits in fiat currencies, such as USD or EUR, as well as cryptocurrencies. 5. Select your assets: With funds in your account, you can start selecting the digital assets you want to invest in. Consider factors such as the asset's market cap, trading volume, and potential for growth. 6. Place your order: Once you've chosen your assets, place an order on the exchange. You can choose to buy assets at the current market price or set a specific price at which you want to buy. 7. Monitor your investments: Keep an eye on how your investments are performing and stay updated with market news and trends. Consider setting stop-loss orders to protect your investment. Remember, investing in digital assets carries risks, so it's important to do your due diligence and only invest what you can afford to lose.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - Investing in digital assets with real money can be a rewarding experience. Here are the steps to get started: 1. Educate yourself: Before you start investing, it's important to educate yourself about digital assets. Learn about different types of digital assets, such as cryptocurrencies, tokens, and digital securities. Understand the underlying technology and the factors that can impact their value. 2. Choose a reliable exchange: Find a reputable exchange that offers a wide range of digital assets and has a strong security system. Look for user-friendly interfaces and good customer support. 3. Create an account: Once you've chosen an exchange, create an account by providing the required information. Some exchanges may require identity verification. 4. Deposit funds: After creating an account, deposit funds into it. Most exchanges accept fiat currencies, such as USD or EUR, as well as cryptocurrencies. 5. Select your assets: With funds in your account, choose the digital assets you want to invest in. Consider factors such as market trends, the asset's performance, and its potential for growth. 6. Place your order: Once you've selected your assets, place an order on the exchange. You can choose to buy assets at the current market price or set a specific price. 7. Monitor your investments: Keep track of your investments and stay updated with market news. Consider setting stop-loss orders to protect your investment. Remember, investing in digital assets involves risks, so it's important to do thorough research and only invest what you can afford to lose.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago

Related Tags

Hot Questions

- 94

What are the advantages of using cryptocurrency for online transactions?

- 91

How can I protect my digital assets from hackers?

- 86

What are the best digital currencies to invest in right now?

- 77

Are there any special tax rules for crypto investors?

- 74

How can I minimize my tax liability when dealing with cryptocurrencies?

- 72

What are the tax implications of using cryptocurrency?

- 48

How does cryptocurrency affect my tax return?

- 30

What are the best practices for reporting cryptocurrency on my taxes?