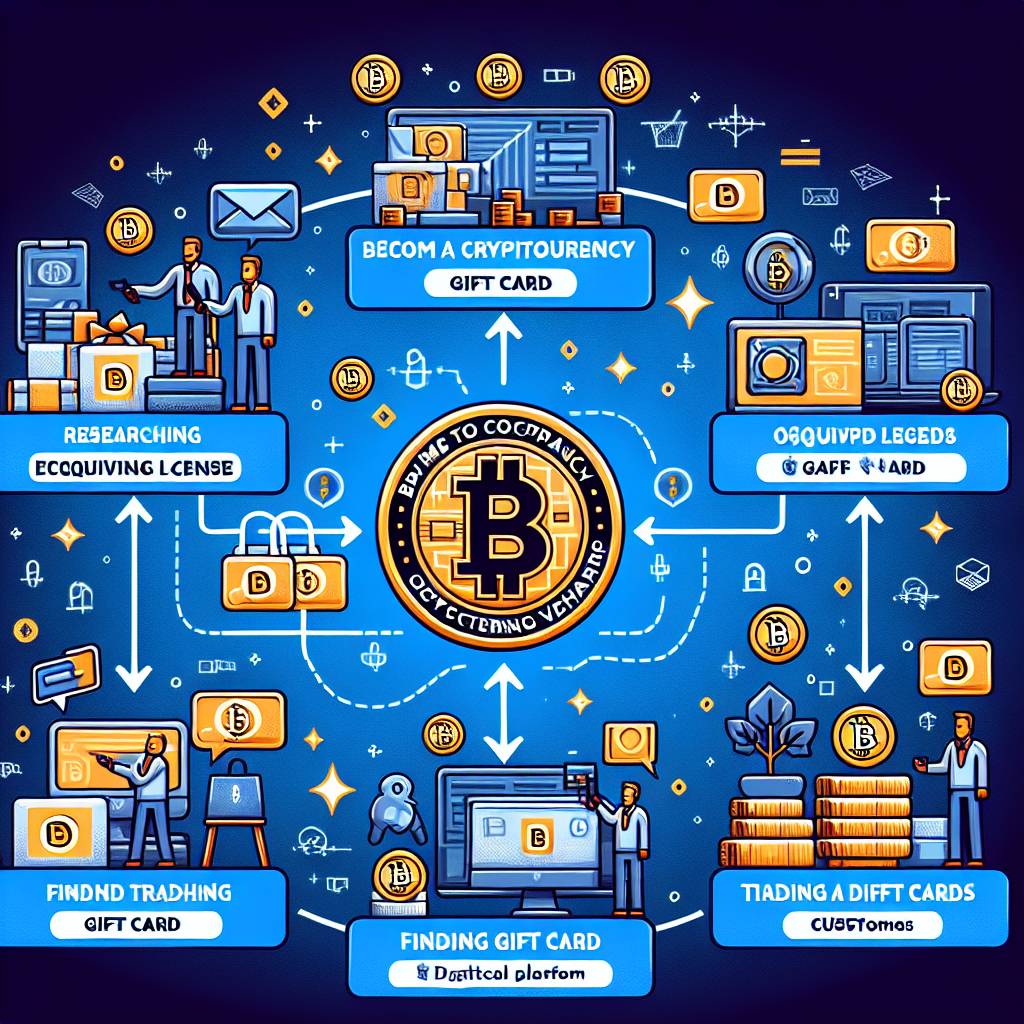

What are the steps to become a cryptocurrency investment broker?

Can you provide a step-by-step guide on how to become a cryptocurrency investment broker? I'm interested in pursuing a career in this field and would like to know the necessary steps to get started.

3 answers

- Becoming a cryptocurrency investment broker requires a combination of education, experience, and industry knowledge. Here are the steps you can follow: 1. Obtain a relevant degree or certification in finance, economics, or a related field. This will provide you with a solid foundation in financial markets and investment principles. 2. Gain experience in the financial industry by working for a brokerage firm or investment bank. This will help you develop the necessary skills and knowledge to succeed as a cryptocurrency investment broker. 3. Stay updated with the latest trends and developments in the cryptocurrency market. Attend conferences, read industry publications, and join online communities to expand your knowledge and network. 4. Obtain the necessary licenses and certifications required to operate as a broker in your jurisdiction. This may include passing exams and meeting certain regulatory requirements. 5. Build a strong network of clients and investors. This can be done through networking events, referrals, and online marketing. 6. Develop a solid investment strategy and portfolio management skills. This will help you attract and retain clients by offering them profitable investment opportunities. 7. Continuously educate yourself and stay updated with the ever-changing cryptocurrency market. This will ensure that you can provide the best possible advice and services to your clients. Remember, becoming a successful cryptocurrency investment broker requires hard work, dedication, and a deep understanding of the market. Good luck on your journey!

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - Becoming a cryptocurrency investment broker is an exciting career choice. Here are the steps you can take: 1. Educate yourself about cryptocurrencies and blockchain technology. This will give you a solid foundation to understand the market and its potential. 2. Gain experience in the financial industry. This can be done by working for a brokerage firm, investment bank, or even starting your own investment portfolio. 3. Obtain the necessary licenses and certifications. Depending on your jurisdiction, you may need to pass exams and meet certain requirements to operate as a broker. 4. Build a strong network of clients and investors. Attend industry events, join online communities, and leverage social media to connect with potential clients. 5. Stay updated with the latest market trends and news. The cryptocurrency market is highly volatile and constantly evolving, so it's important to stay informed. 6. Develop your own investment strategy. This will help you attract clients and provide them with tailored investment solutions. 7. Continuously educate yourself. The cryptocurrency market is still relatively new, and there's always something new to learn. By following these steps, you'll be on your way to becoming a successful cryptocurrency investment broker!

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - At BYDFi, we believe that becoming a cryptocurrency investment broker requires a combination of knowledge, experience, and dedication. Here are the steps you can take: 1. Educate yourself about cryptocurrencies and blockchain technology. This will give you a solid understanding of the market and its potential. 2. Gain experience in the financial industry. This can be done by working for a brokerage firm, investment bank, or even starting your own investment portfolio. 3. Obtain the necessary licenses and certifications. Depending on your jurisdiction, you may need to pass exams and meet certain requirements to operate as a broker. 4. Build a strong network of clients and investors. Attend industry events, join online communities, and leverage social media to connect with potential clients. 5. Stay updated with the latest market trends and news. The cryptocurrency market is highly volatile and constantly evolving, so it's important to stay informed. 6. Develop your own investment strategy. This will help you attract clients and provide them with tailored investment solutions. 7. Continuously educate yourself. The cryptocurrency market is still relatively new, and there's always something new to learn. Remember, becoming a successful cryptocurrency investment broker takes time and effort. Stay committed to your goals and never stop learning!

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago

Related Tags

Hot Questions

- 87

Are there any special tax rules for crypto investors?

- 85

What are the advantages of using cryptocurrency for online transactions?

- 75

How can I minimize my tax liability when dealing with cryptocurrencies?

- 58

What are the tax implications of using cryptocurrency?

- 50

How can I buy Bitcoin with a credit card?

- 43

What is the future of blockchain technology?

- 27

How can I protect my digital assets from hackers?

- 19

What are the best digital currencies to invest in right now?