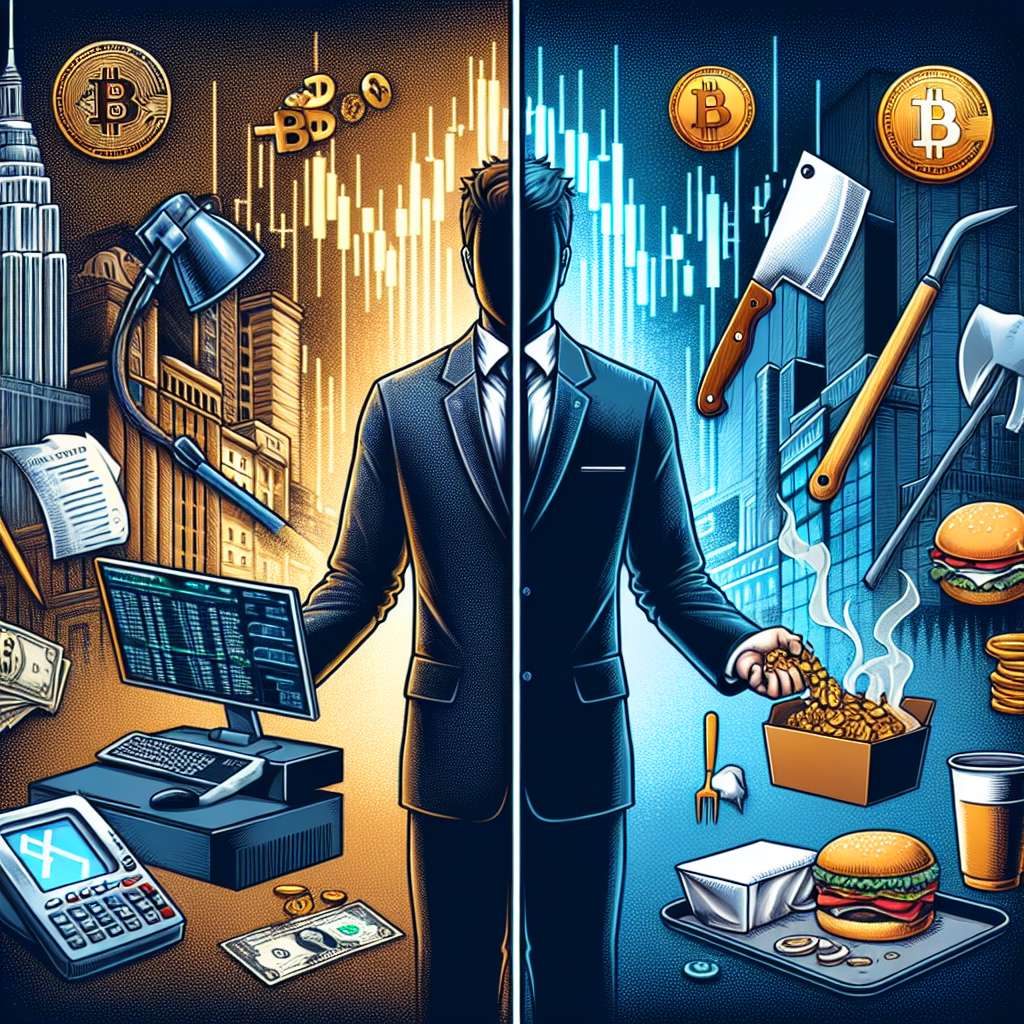

What are the risks and rewards of choosing fidelity vs jp morgan over cryptocurrency for investment?

When considering fidelity and jp morgan as investment options compared to cryptocurrency, what are the potential risks and rewards associated with each choice?

3 answers

- Investing in fidelity or jp morgan can provide a sense of security and stability, as these institutions have a long history and established reputation in the financial industry. However, the potential rewards may be limited compared to the high volatility and potential growth of cryptocurrencies. It's important to consider the potential risks of investing in fidelity or jp morgan, such as lower returns compared to the potential gains in the cryptocurrency market. Additionally, the traditional financial system may have limitations in terms of accessibility and transparency compared to the decentralized nature of cryptocurrencies.

Nov 24, 2021 · 3 years ago

Nov 24, 2021 · 3 years ago - Choosing fidelity or jp morgan over cryptocurrency for investment can be a more conservative approach, as these institutions offer traditional investment options such as stocks, bonds, and mutual funds. This can be suitable for investors who prefer a more predictable and regulated investment environment. However, the potential rewards may be lower compared to the potential gains in the cryptocurrency market. It's important to carefully assess your risk tolerance and investment goals before making a decision.

Nov 24, 2021 · 3 years ago

Nov 24, 2021 · 3 years ago - BYDFi, a digital currency exchange, offers a wide range of cryptocurrency investment options. While fidelity and jp morgan provide stability and a trusted reputation, BYDFi offers the potential for higher returns due to the volatility and growth of the cryptocurrency market. However, it's important to note that investing in cryptocurrencies also comes with higher risks, such as market volatility and regulatory uncertainties. It's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions.

Nov 24, 2021 · 3 years ago

Nov 24, 2021 · 3 years ago

Related Tags

Hot Questions

- 94

How can I buy Bitcoin with a credit card?

- 85

What are the best digital currencies to invest in right now?

- 82

Are there any special tax rules for crypto investors?

- 78

What are the tax implications of using cryptocurrency?

- 70

How does cryptocurrency affect my tax return?

- 47

What are the best practices for reporting cryptocurrency on my taxes?

- 43

How can I minimize my tax liability when dealing with cryptocurrencies?

- 28

What is the future of blockchain technology?