What are the potential risks of a contagion effect in the digital currency space?

In the digital currency space, what are the potential risks associated with a contagion effect? How can a contagion effect impact the digital currency market and its participants?

3 answers

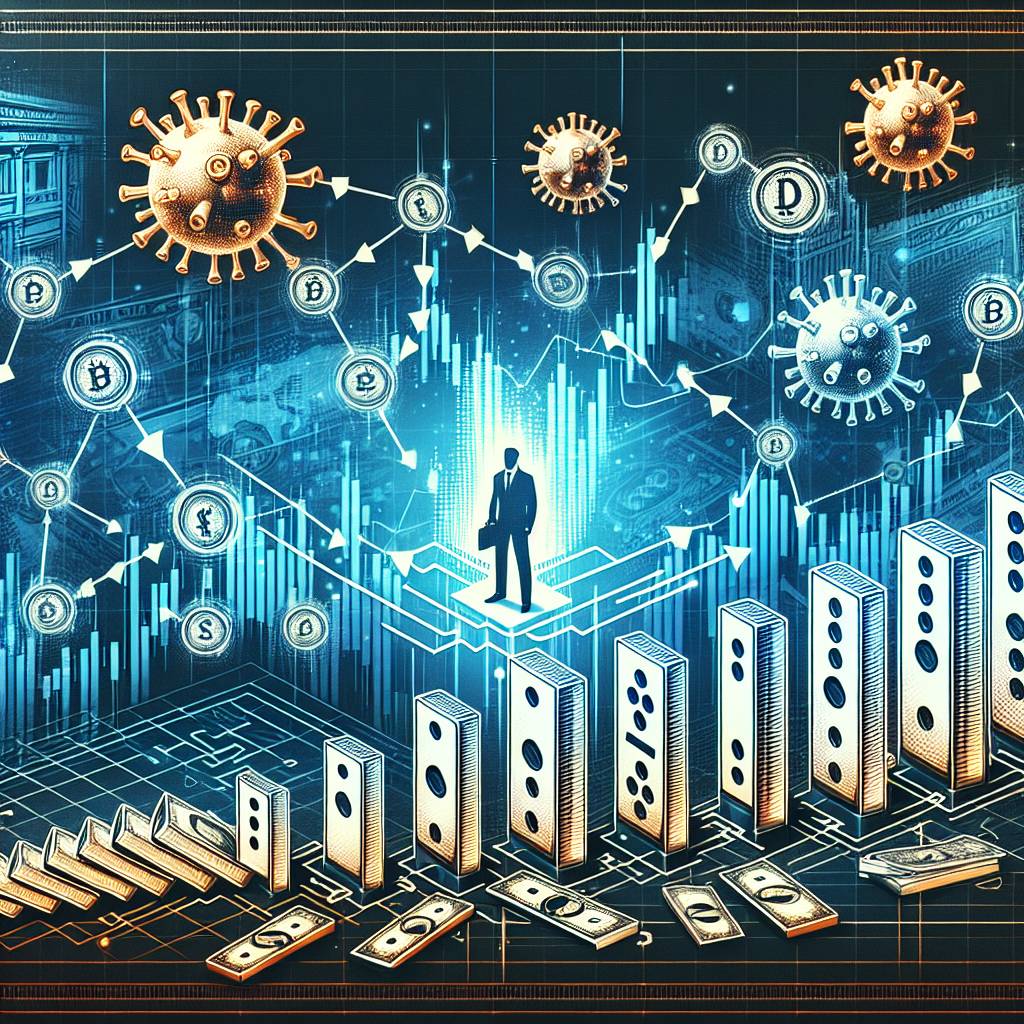

- A contagion effect in the digital currency space refers to the spread of negative sentiment or events from one cryptocurrency to others, leading to a widespread decline in value. This can occur due to various factors such as market manipulation, regulatory actions, security breaches, or even negative news affecting a specific cryptocurrency. The risks of a contagion effect include increased market volatility, loss of investor confidence, and potential financial losses for individuals and institutions holding digital currencies. It is important for investors to diversify their portfolios and stay updated on market trends and news to mitigate the risks associated with a contagion effect.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - When a contagion effect occurs in the digital currency space, it can have a domino effect on the entire market. The interconnectedness of cryptocurrencies and the speed at which information spreads can amplify the impact of negative events. For example, if a major cryptocurrency experiences a significant drop in value due to a security breach, it can trigger panic selling and a decline in other cryptocurrencies as well. This can lead to a cascading effect, causing widespread losses for investors. To protect against the risks of a contagion effect, it is crucial to have a well-diversified portfolio, conduct thorough research before investing, and stay informed about the latest developments in the digital currency space.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - In the digital currency space, a contagion effect can have far-reaching consequences. As an exchange, BYDFi understands the importance of maintaining a secure and transparent trading environment to mitigate the risks associated with a contagion effect. We employ robust security measures, conduct regular audits, and collaborate with regulatory authorities to ensure the safety of our users' funds. Additionally, we provide educational resources and market analysis to help our users make informed investment decisions. While the risks of a contagion effect exist, it is important to remember that the digital currency market is still evolving, and with proper risk management strategies, investors can navigate these risks and potentially benefit from the opportunities presented by this emerging asset class.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago

Related Tags

Hot Questions

- 92

What is the future of blockchain technology?

- 74

How can I buy Bitcoin with a credit card?

- 69

How can I protect my digital assets from hackers?

- 59

What are the tax implications of using cryptocurrency?

- 51

How can I minimize my tax liability when dealing with cryptocurrencies?

- 39

Are there any special tax rules for crypto investors?

- 38

What are the best digital currencies to invest in right now?

- 36

How does cryptocurrency affect my tax return?