What are the key steps involved in the pre-launch phase of a cryptocurrency initial public offering (IPO)?

Can you provide a detailed explanation of the key steps involved in the pre-launch phase of a cryptocurrency initial public offering (IPO)?

3 answers

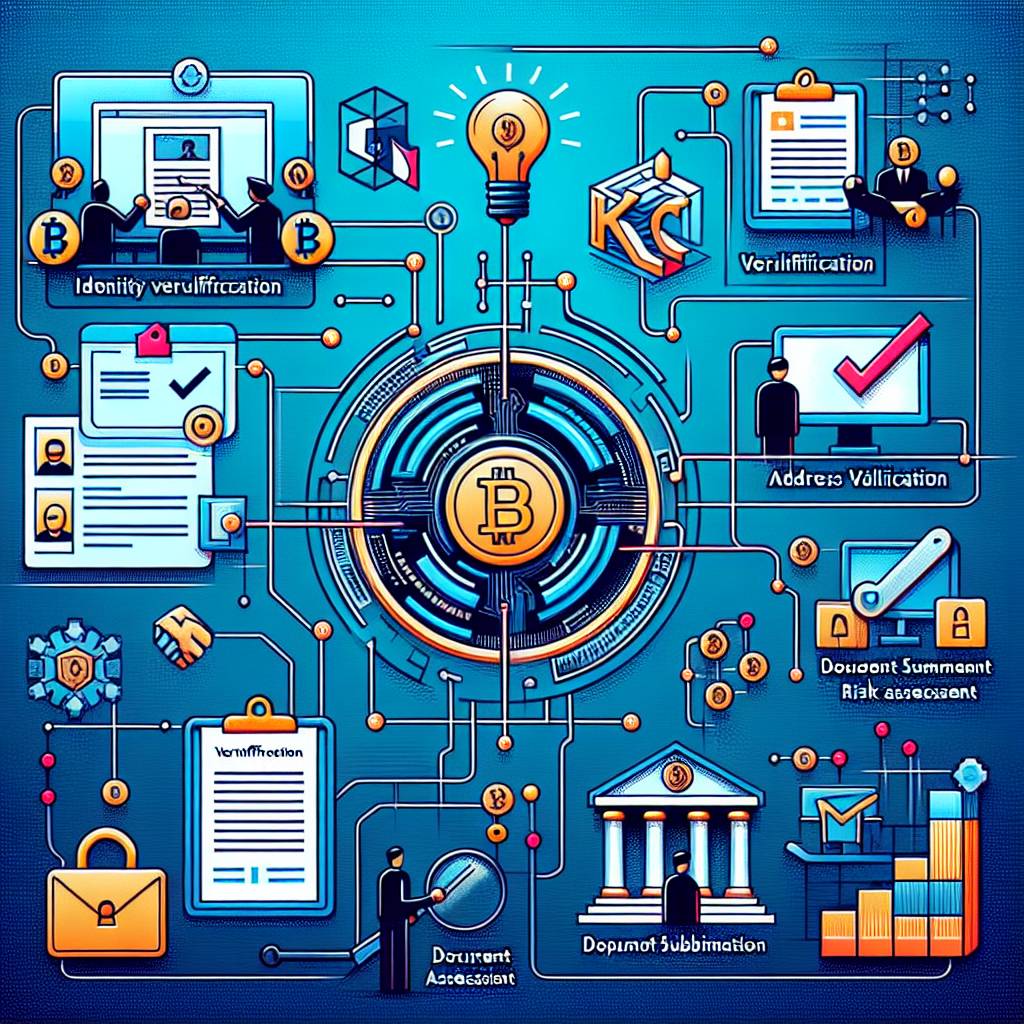

- Sure! The pre-launch phase of a cryptocurrency IPO involves several important steps. First, the company needs to conduct thorough market research to identify potential investors and gauge market demand. Then, they must develop a comprehensive whitepaper that outlines the project's goals, technology, and token economics. Next, the company needs to create a strong online presence through social media marketing, content creation, and community engagement. Additionally, they should establish partnerships with reputable exchanges to ensure a smooth listing process. Finally, the company should conduct a private sale or pre-sale to attract early investors and raise funds for the project. Overall, the pre-launch phase requires careful planning, effective marketing strategies, and strong partnerships to ensure a successful cryptocurrency IPO.

Feb 18, 2022 · 3 years ago

Feb 18, 2022 · 3 years ago - The pre-launch phase of a cryptocurrency IPO is crucial for setting the foundation of a successful project. It involves conducting market research, developing a whitepaper, building an online presence, establishing partnerships, and conducting private sales. These steps are essential for attracting investors, creating awareness, and raising funds. Without a well-executed pre-launch phase, a cryptocurrency IPO may struggle to gain traction in the competitive market.

Feb 18, 2022 · 3 years ago

Feb 18, 2022 · 3 years ago - In the pre-launch phase of a cryptocurrency IPO, it is important to conduct thorough market research to understand the target audience and competition. This research helps in identifying potential investors and designing effective marketing strategies. Developing a detailed whitepaper is also crucial as it provides investors with a clear understanding of the project's goals and technology. Building a strong online presence through social media platforms and engaging with the community helps in creating awareness and generating interest. Establishing partnerships with reputable exchanges ensures a smooth listing process and enhances the project's credibility. Finally, conducting private sales or pre-sales allows the project to raise funds and attract early investors. Overall, the pre-launch phase plays a vital role in the success of a cryptocurrency IPO.

Feb 18, 2022 · 3 years ago

Feb 18, 2022 · 3 years ago

Related Tags

Hot Questions

- 99

How can I buy Bitcoin with a credit card?

- 92

What is the future of blockchain technology?

- 81

How does cryptocurrency affect my tax return?

- 72

What are the best practices for reporting cryptocurrency on my taxes?

- 45

What are the best digital currencies to invest in right now?

- 43

Are there any special tax rules for crypto investors?

- 32

What are the tax implications of using cryptocurrency?

- 28

How can I minimize my tax liability when dealing with cryptocurrencies?