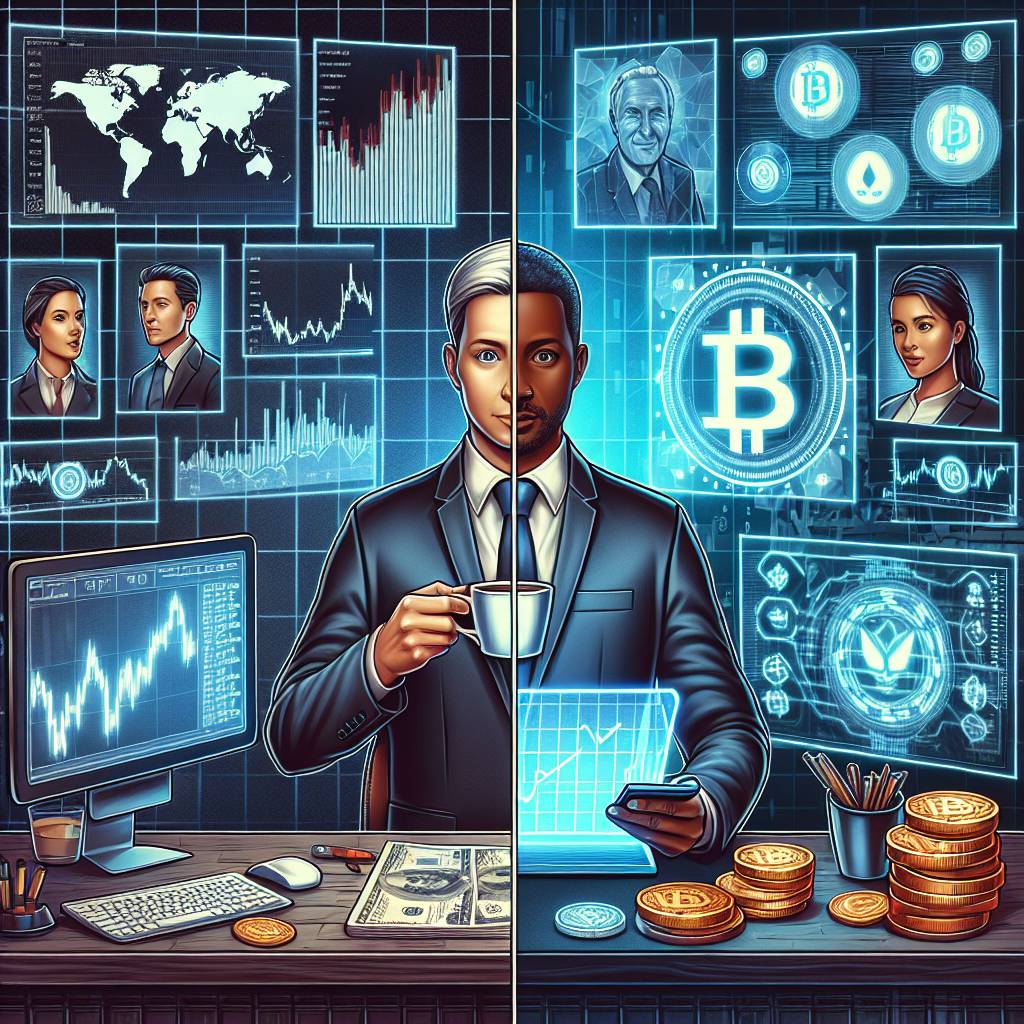

What are the key differences between playing the stock market and trading cryptocurrency?

What are the main distinctions between engaging in stock market activities and participating in cryptocurrency trading? How do these two types of investments differ in terms of risk, regulations, liquidity, and potential returns?

6 answers

- When it comes to risk, the stock market and cryptocurrency trading have different characteristics. While the stock market is generally considered less volatile and more stable due to the regulation and oversight it receives, cryptocurrency trading is known for its high volatility. Cryptocurrencies can experience significant price fluctuations within short periods of time, which can lead to both substantial gains and losses. Therefore, investors should be prepared for higher levels of risk when trading cryptocurrencies.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - In terms of regulations, the stock market is subject to strict oversight by regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States. These regulations aim to protect investors and ensure fair and transparent trading practices. On the other hand, the cryptocurrency market is relatively new and less regulated. While some countries have implemented regulations, the level of oversight varies greatly. This regulatory uncertainty can impact investor confidence and introduce additional risks.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - As for liquidity, the stock market generally offers higher liquidity compared to the cryptocurrency market. Stocks of well-established companies are traded on major exchanges, making it easier for investors to buy and sell shares at any time. Cryptocurrencies, on the other hand, may have lower liquidity, especially for less popular or newly launched coins. This can result in higher bid-ask spreads and potential difficulties in executing trades.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - Now, let's talk about potential returns. While the stock market has a long history of providing solid returns over the long term, cryptocurrency trading has the potential for higher short-term gains. The cryptocurrency market has witnessed significant price surges in the past, leading to substantial profits for early investors. However, it's important to note that these gains come with higher risks and the potential for significant losses as well. It's crucial for investors to carefully assess their risk tolerance and investment goals before venturing into cryptocurrency trading.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - As a representative of BYDFi, I must mention that our platform offers a user-friendly interface and a wide range of cryptocurrencies for trading. We strive to provide a secure and reliable trading environment for cryptocurrency enthusiasts. However, it's important to conduct thorough research and seek professional advice before making any investment decisions, regardless of the platform you choose.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - Trading in the stock market and cryptocurrency market can be exciting and potentially profitable. However, it's essential to understand the key differences between the two. While the stock market offers stability, regulation, and higher liquidity, cryptocurrency trading is characterized by its volatility, regulatory uncertainty, and potential for high short-term returns. Investors should carefully consider their risk tolerance, investment goals, and conduct thorough research before engaging in either market.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago

Related Tags

Hot Questions

- 84

What are the best digital currencies to invest in right now?

- 50

How does cryptocurrency affect my tax return?

- 49

How can I buy Bitcoin with a credit card?

- 32

What are the best practices for reporting cryptocurrency on my taxes?

- 28

What is the future of blockchain technology?

- 25

What are the advantages of using cryptocurrency for online transactions?

- 19

Are there any special tax rules for crypto investors?

- 17

How can I protect my digital assets from hackers?