What are the key differences between e-mini futures and traditional futures in the cryptocurrency industry?

Can you explain the main distinctions between e-mini futures and traditional futures in the cryptocurrency industry? How do they differ in terms of trading volume, contract size, and settlement? Are there any specific advantages or disadvantages of each type of futures?

1 answers

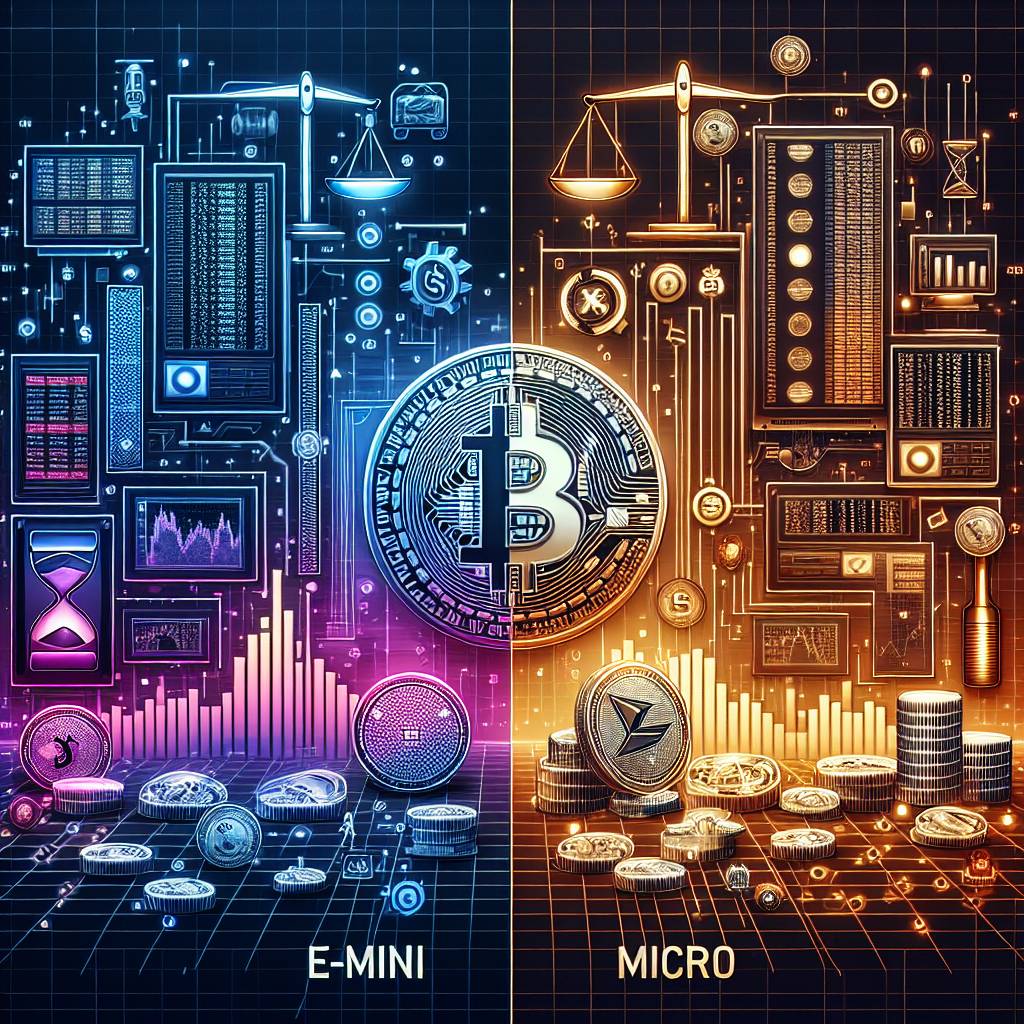

- When it comes to e-mini futures and traditional futures in the cryptocurrency industry, there are a few key differences to consider. E-mini futures are designed to be more accessible to retail traders, with smaller contract sizes and lower trading volumes. This makes them a popular choice for individual investors who want to participate in the cryptocurrency market without committing large amounts of capital. Traditional futures, on the other hand, are often traded by institutional investors and have larger contract sizes. They also offer the option of physical delivery of the underlying asset upon settlement. While e-mini futures provide a convenient way for retail traders to get involved in cryptocurrency futures trading, traditional futures offer more flexibility and potential for larger profits for those with the necessary capital and risk appetite. It's important for traders to carefully consider their goals and resources before deciding which type of futures to trade.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago

Related Tags

Hot Questions

- 85

How can I buy Bitcoin with a credit card?

- 82

How does cryptocurrency affect my tax return?

- 74

Are there any special tax rules for crypto investors?

- 74

What are the best practices for reporting cryptocurrency on my taxes?

- 71

How can I minimize my tax liability when dealing with cryptocurrencies?

- 63

What are the advantages of using cryptocurrency for online transactions?

- 54

What are the best digital currencies to invest in right now?

- 22

How can I protect my digital assets from hackers?