What are the differences between perpetual trading and spot trading in the crypto market?

Can you explain the key differences between perpetual trading and spot trading in the cryptocurrency market? How do these two types of trading work and what are their advantages and disadvantages?

1 answers

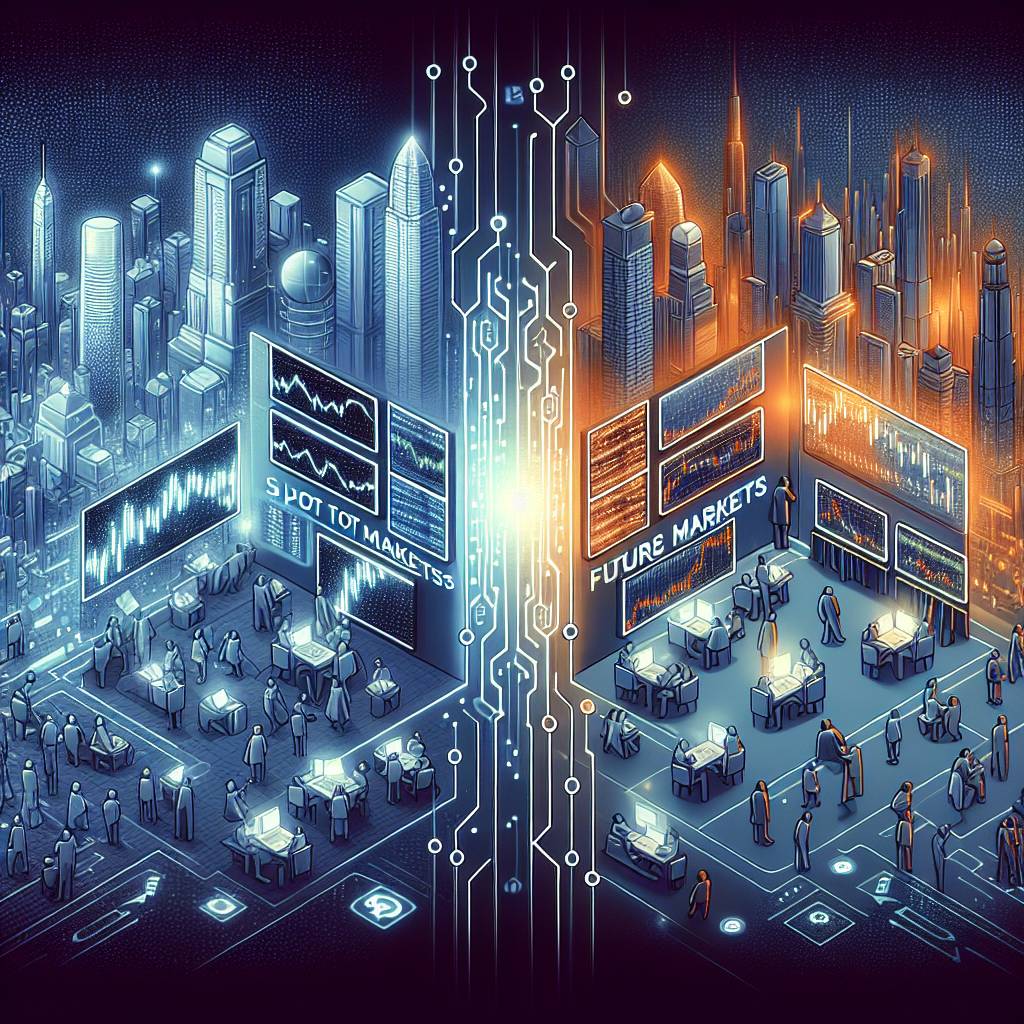

- Perpetual trading and spot trading are two different ways to trade cryptocurrencies. Perpetual trading, also known as perpetual contracts or futures contracts, allows traders to speculate on the price movement of an underlying asset without actually owning the asset. Spot trading, on the other hand, involves buying and selling the actual cryptocurrency asset. One key difference between perpetual trading and spot trading is the use of leverage. Perpetual trading allows traders to trade with borrowed funds, which can amplify their potential profits or losses. Spot trading, on the other hand, does not involve leverage and traders can only trade with the funds they have in their account. Another difference is the settlement. In perpetual trading, there is no expiration date for the contract, and traders can hold their positions indefinitely. The contract is settled periodically to ensure that the price of the contract stays close to the spot price of the underlying asset. Spot trading, on the other hand, involves immediate settlement, where the buyer pays for the cryptocurrency and the seller delivers the cryptocurrency immediately. Both perpetual trading and spot trading have their own advantages and disadvantages. Perpetual trading offers the potential for higher returns due to leverage, but it also carries higher risks. Spot trading, on the other hand, is more straightforward and less risky, but it may not offer the same level of profit potential as perpetual trading. It ultimately depends on the trader's risk tolerance and trading strategy.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago

Related Tags

Hot Questions

- 79

How can I protect my digital assets from hackers?

- 75

Are there any special tax rules for crypto investors?

- 73

How can I minimize my tax liability when dealing with cryptocurrencies?

- 67

What are the best practices for reporting cryptocurrency on my taxes?

- 59

What are the tax implications of using cryptocurrency?

- 54

What are the advantages of using cryptocurrency for online transactions?

- 49

How does cryptocurrency affect my tax return?

- 43

What are the best digital currencies to invest in right now?