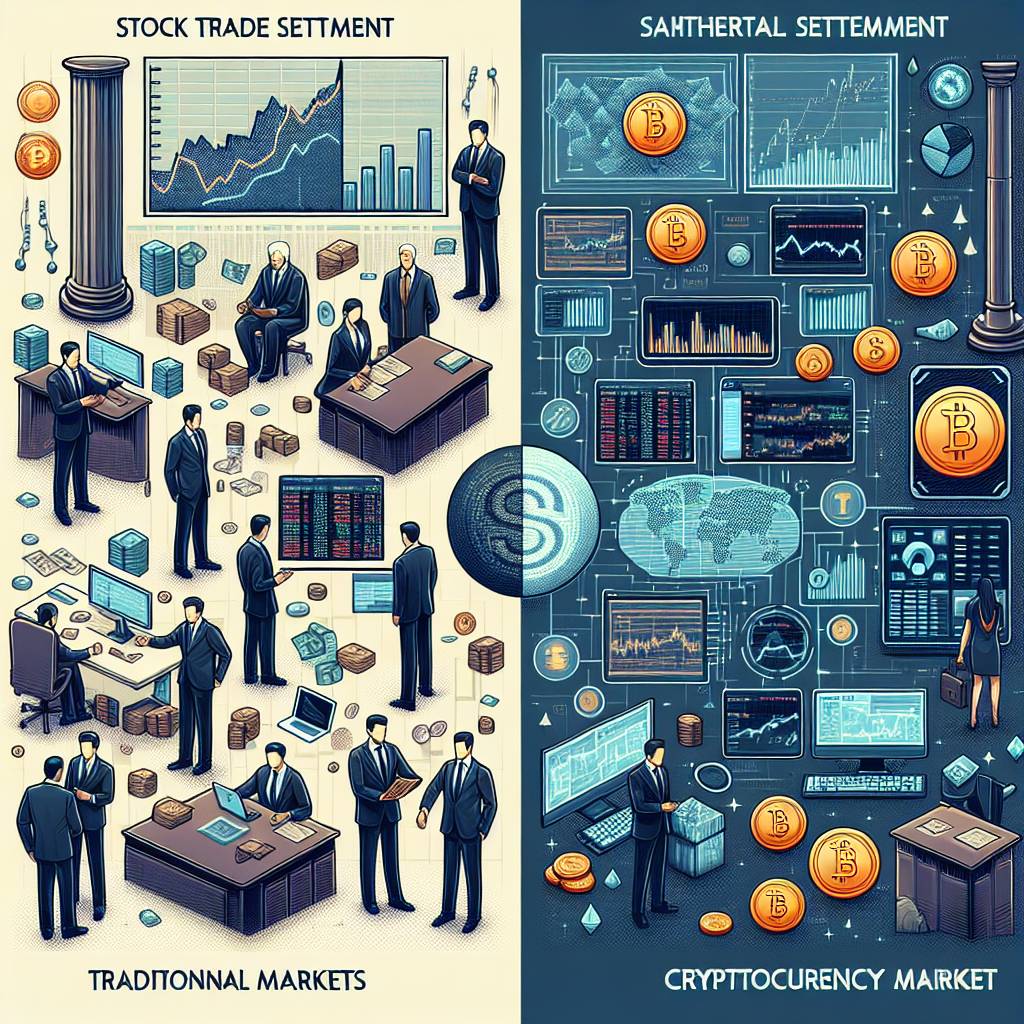

What are the differences between domestic stock trading and cryptocurrency trading?

Can you explain the key differences between trading stocks in domestic markets and trading cryptocurrencies? How do the two types of trading differ in terms of regulations, market dynamics, and investment strategies?

3 answers

- Trading stocks in domestic markets and trading cryptocurrencies are quite different in several aspects. Firstly, regulations play a major role in stock trading, with strict oversight from regulatory bodies. On the other hand, cryptocurrency trading operates in a relatively unregulated environment, which can lead to higher volatility. Secondly, the market dynamics differ significantly. Stock markets are influenced by factors such as company performance, economic indicators, and investor sentiment. Cryptocurrency markets, however, are driven by factors like technological developments, news events, and market speculation. Lastly, investment strategies also vary. Stock trading often involves long-term investments, dividend income, and fundamental analysis. Cryptocurrency trading, on the other hand, is characterized by short-term trading, technical analysis, and the potential for high returns. Overall, while both types of trading involve financial instruments, they differ in terms of regulations, market dynamics, and investment strategies.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago - When it comes to trading stocks in domestic markets and trading cryptocurrencies, there are several key differences to consider. One major difference is the level of regulation. Stock trading is heavily regulated, with strict rules and oversight from regulatory bodies. On the other hand, cryptocurrency trading operates in a more decentralized and less regulated environment. This lack of regulation can lead to increased volatility and risks in the cryptocurrency market. Another difference is the market dynamics. Stock markets are influenced by factors such as company performance, economic indicators, and investor sentiment. Cryptocurrency markets, on the other hand, are driven by factors like technological advancements, news events, and market speculation. Additionally, the investment strategies used in these two types of trading can vary significantly. Stock trading often involves long-term investments, dividend income, and fundamental analysis. Cryptocurrency trading, on the other hand, is characterized by short-term trading, technical analysis, and the potential for high returns. In summary, while both domestic stock trading and cryptocurrency trading involve financial instruments, they differ in terms of regulation, market dynamics, and investment strategies.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago - The differences between domestic stock trading and cryptocurrency trading are quite significant. In stock trading, there are strict regulations and oversight from regulatory bodies, ensuring transparency and investor protection. On the other hand, cryptocurrency trading operates in a relatively unregulated environment, which can lead to higher risks and volatility. As for market dynamics, stock markets are influenced by factors such as company performance, economic indicators, and investor sentiment. Cryptocurrency markets, however, are driven by factors like technological developments, news events, and market speculation. When it comes to investment strategies, stock trading often involves long-term investments, dividend income, and fundamental analysis. Cryptocurrency trading, on the other hand, is characterized by short-term trading, technical analysis, and the potential for high returns. It's important to note that these differences make each type of trading unique and require different approaches. Therefore, it's crucial to understand the nuances of each market before engaging in trading activities.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago

Related Tags

Hot Questions

- 75

What are the tax implications of using cryptocurrency?

- 66

How can I buy Bitcoin with a credit card?

- 61

How can I protect my digital assets from hackers?

- 36

What are the best digital currencies to invest in right now?

- 35

Are there any special tax rules for crypto investors?

- 34

How can I minimize my tax liability when dealing with cryptocurrencies?

- 33

How does cryptocurrency affect my tax return?

- 23

What are the advantages of using cryptocurrency for online transactions?