What are the differences between custodial and individual 529 plans in the context of cryptocurrency?

Can you explain the distinctions between custodial and individual 529 plans when it comes to cryptocurrency investments? How do these two types of plans differ in terms of ownership, control, and tax benefits?

3 answers

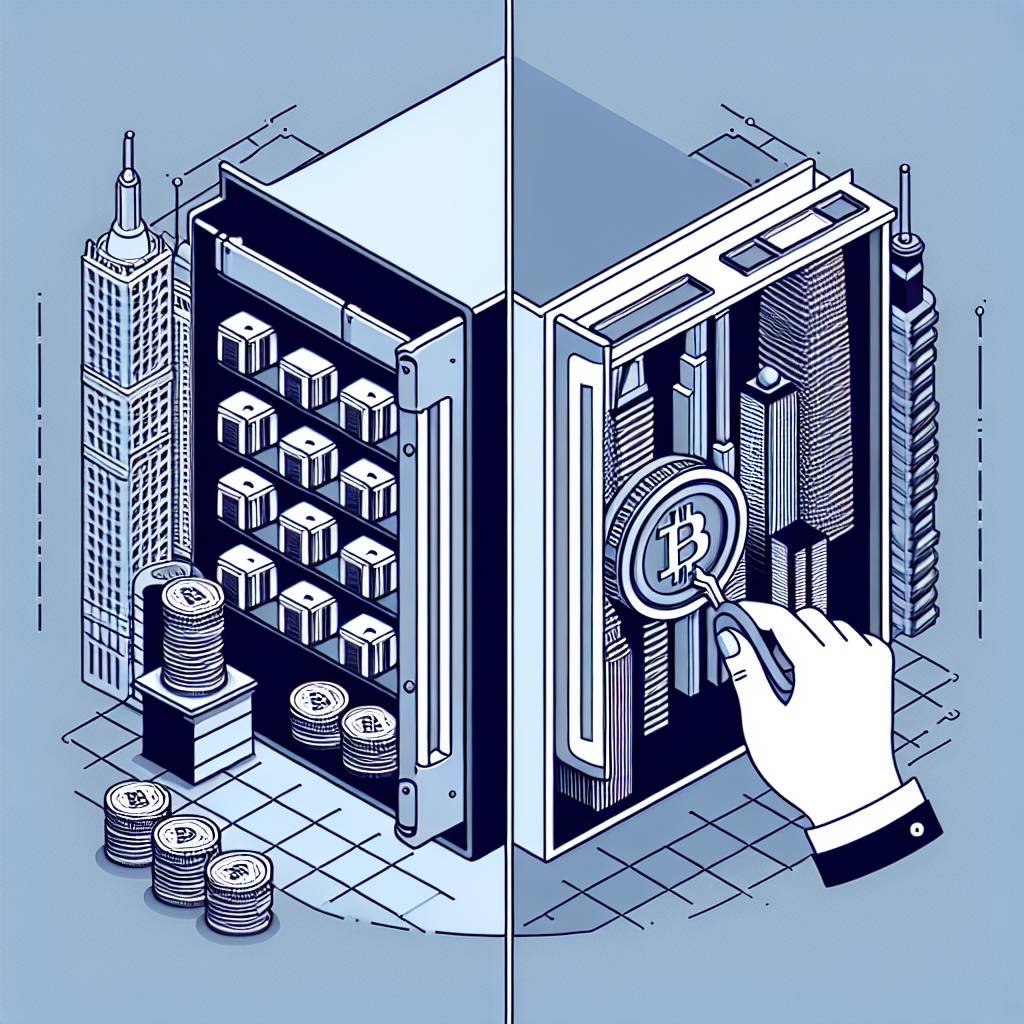

- Custodial 529 plans are managed by a custodian, typically a financial institution, who holds and controls the assets on behalf of the beneficiary. In contrast, individual 529 plans allow the account owner to have direct control over the investments. When it comes to cryptocurrency, custodial 529 plans may offer more security as the custodian takes responsibility for safeguarding the digital assets. However, individual 529 plans provide greater flexibility and control over the investment choices, allowing the account owner to directly invest in cryptocurrencies of their choice. It's important to note that the tax benefits associated with 529 plans apply to both custodial and individual plans, allowing for tax-free growth and withdrawals for qualified education expenses.

Feb 18, 2022 · 3 years ago

Feb 18, 2022 · 3 years ago - When it comes to cryptocurrency, custodial 529 plans can be compared to storing your digital assets in a secure vault managed by a trusted third party. The custodian ensures the safety and security of your investments, reducing the risk of loss or theft. On the other hand, individual 529 plans are like having full control over your own digital wallet. You have the freedom to choose which cryptocurrencies to invest in and can actively manage your portfolio. However, this also means you bear the responsibility of securing your assets and protecting them from potential risks. Both types of plans offer tax advantages, allowing you to grow your investments without incurring taxes as long as the funds are used for qualified education expenses.

Feb 18, 2022 · 3 years ago

Feb 18, 2022 · 3 years ago - BYDFi, a digital currency exchange, offers custodial 529 plans that provide a secure and reliable way to invest in cryptocurrencies for education savings. With BYDFi's custodial plans, you can benefit from professional asset management and enhanced security measures to protect your digital assets. The custodian ensures that your investments are held securely and can assist with any technical or security-related issues. This allows you to focus on your education savings goals while having peace of mind knowing that your cryptocurrencies are in safe hands. Additionally, BYDFi's custodial 529 plans offer the same tax advantages as traditional custodial plans, making them a convenient option for cryptocurrency investors looking to save for education expenses.

Feb 18, 2022 · 3 years ago

Feb 18, 2022 · 3 years ago

Related Tags

Hot Questions

- 96

How does cryptocurrency affect my tax return?

- 95

What is the future of blockchain technology?

- 90

What are the tax implications of using cryptocurrency?

- 85

How can I minimize my tax liability when dealing with cryptocurrencies?

- 83

What are the best digital currencies to invest in right now?

- 77

What are the best practices for reporting cryptocurrency on my taxes?

- 59

What are the advantages of using cryptocurrency for online transactions?

- 56

How can I protect my digital assets from hackers?