What are the best ways to automate cryptocurrency investments on Fidelity?

I'm interested in automating my cryptocurrency investments on Fidelity. Can you provide me with some guidance on the best ways to do this? I want to make sure I'm taking advantage of the latest automation tools and strategies to optimize my investments.

4 answers

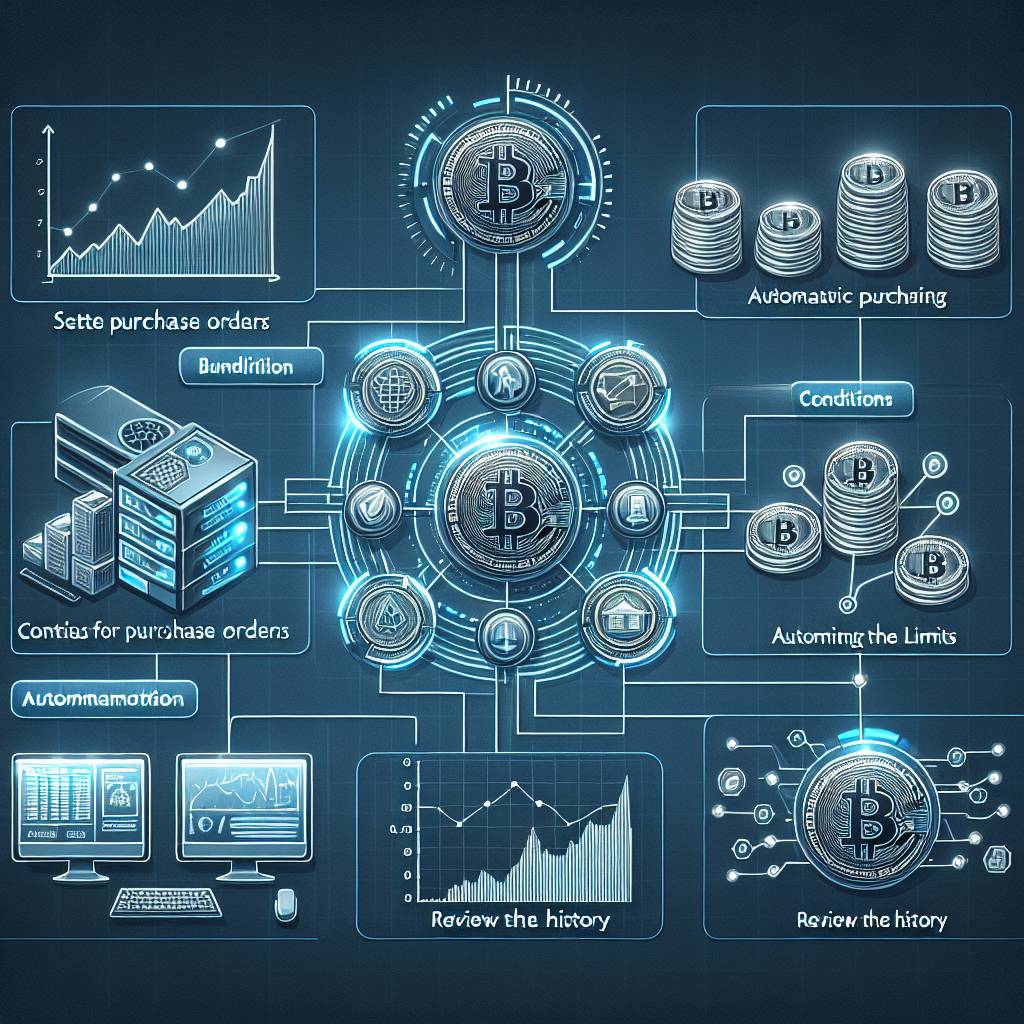

- One of the best ways to automate your cryptocurrency investments on Fidelity is by using their automated investment tools. Fidelity offers a range of options, including automatic recurring investments and rebalancing. By setting up recurring investments, you can regularly contribute to your cryptocurrency portfolio without having to manually make transactions. Additionally, Fidelity's rebalancing feature can help maintain the desired allocation of your portfolio by automatically buying and selling cryptocurrencies based on market conditions. These tools can save you time and effort while ensuring your investments are consistently managed.

Nov 24, 2021 · 3 years ago

Nov 24, 2021 · 3 years ago - If you're looking for more advanced automation options, you can consider using third-party cryptocurrency trading bots. These bots are designed to execute trades on your behalf based on predefined strategies and parameters. They can analyze market data, identify trading opportunities, and automatically place buy or sell orders. However, it's important to do thorough research and choose a reputable bot that aligns with your investment goals and risk tolerance. Keep in mind that using third-party bots may involve additional costs and potential security risks, so proceed with caution.

Nov 24, 2021 · 3 years ago

Nov 24, 2021 · 3 years ago - BYDFi is a popular cryptocurrency exchange that offers automation features for investors. With BYDFi, you can set up automated trading strategies and execute trades based on predefined conditions. Their platform allows you to create custom trading algorithms and utilize various technical indicators to automate your investment decisions. BYDFi also provides backtesting capabilities, allowing you to test your strategies against historical data before deploying them in live trading. However, it's important to note that BYDFi is just one of the many options available, and it's essential to consider your specific needs and preferences when choosing an exchange for automated cryptocurrency investments.

Nov 24, 2021 · 3 years ago

Nov 24, 2021 · 3 years ago - Automating your cryptocurrency investments on Fidelity can be a great way to take advantage of market opportunities and ensure consistent portfolio management. By leveraging Fidelity's automated investment tools or exploring third-party trading bots, you can save time and potentially optimize your returns. However, it's crucial to stay informed about the latest market trends and regularly review your automated strategies to ensure they align with your investment goals. Remember, automation is a tool that can support your investment decisions, but it's still important to exercise caution and make informed choices based on your risk tolerance and financial objectives.

Nov 24, 2021 · 3 years ago

Nov 24, 2021 · 3 years ago

Related Tags

Hot Questions

- 91

How can I buy Bitcoin with a credit card?

- 91

What is the future of blockchain technology?

- 84

Are there any special tax rules for crypto investors?

- 70

How does cryptocurrency affect my tax return?

- 54

What are the tax implications of using cryptocurrency?

- 53

What are the best practices for reporting cryptocurrency on my taxes?

- 34

How can I minimize my tax liability when dealing with cryptocurrencies?

- 23

What are the advantages of using cryptocurrency for online transactions?