How does the role of a stockbroker differ from that of a cryptocurrency broker?

What are the key differences between the responsibilities and functions of a stockbroker and a cryptocurrency broker?

5 answers

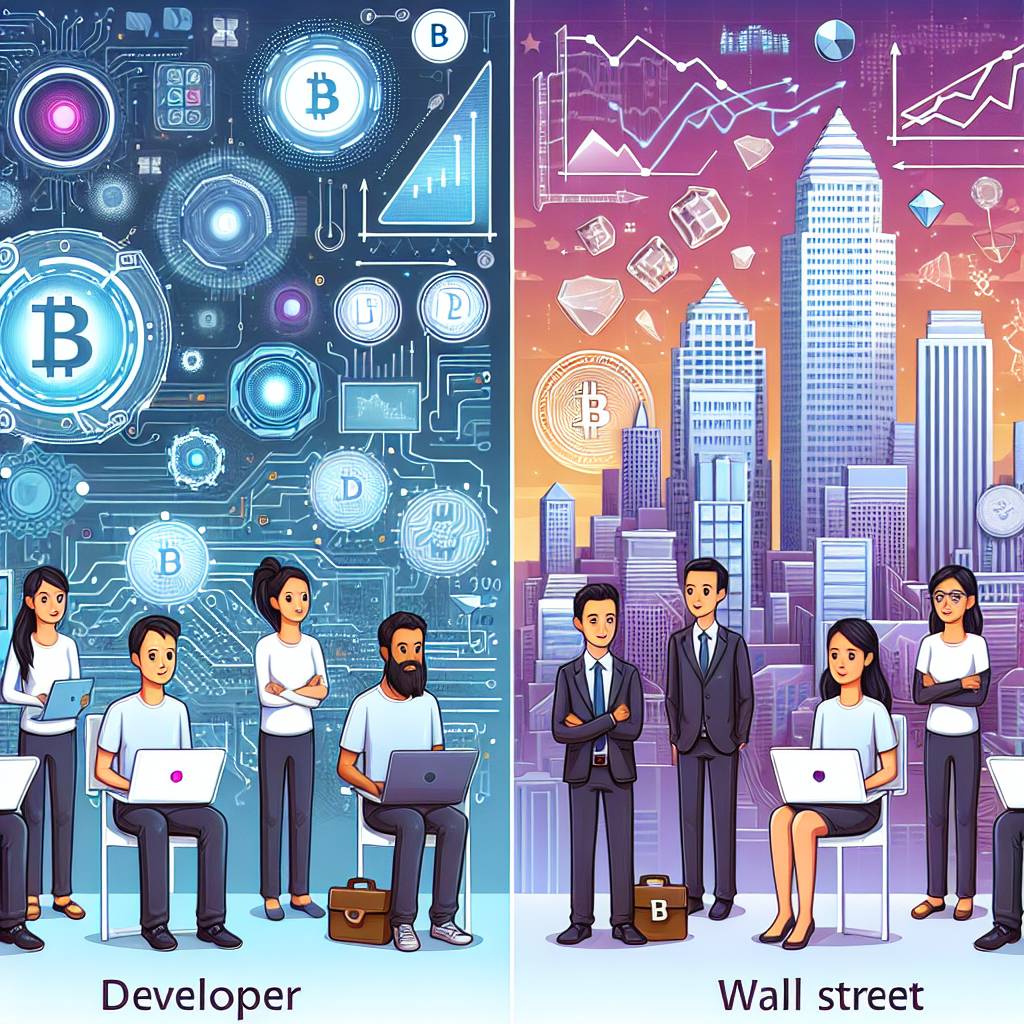

- A stockbroker is a professional who facilitates the buying and selling of stocks and other securities on behalf of clients. They typically work for brokerage firms and are licensed to execute trades on stock exchanges. On the other hand, a cryptocurrency broker specializes in facilitating the trading of cryptocurrencies, such as Bitcoin and Ethereum. They operate on cryptocurrency exchanges and help clients buy and sell digital assets. While both stockbrokers and cryptocurrency brokers deal with financial assets, the main difference lies in the type of assets they handle.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - The role of a stockbroker is more traditional and established, as stock markets have been around for centuries. Stockbrokers provide investment advice, research, and analysis to help clients make informed decisions. They also assist in managing portfolios and executing trades. In contrast, the role of a cryptocurrency broker is relatively new and dynamic, as the cryptocurrency market is still evolving. Cryptocurrency brokers focus on providing access to a wide range of digital assets and ensuring smooth trading experiences for clients.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - At BYDFi, we believe that the key difference between a stockbroker and a cryptocurrency broker is the underlying technology and market dynamics. While stockbrokers operate within regulated and centralized systems, cryptocurrency brokers operate in a decentralized and often unregulated environment. This brings both opportunities and challenges. Cryptocurrency brokers need to stay updated with the latest blockchain technologies, security measures, and market trends to provide reliable services to clients.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - When comparing a stockbroker and a cryptocurrency broker, it's important to consider the level of risk involved. Stock markets are generally considered more stable and less volatile compared to the cryptocurrency market. Stockbrokers focus on long-term investments and diversification strategies to minimize risk. On the other hand, cryptocurrency brokers deal with highly volatile assets and cater to traders who seek short-term gains. They often provide leverage and margin trading options to amplify potential profits.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - While stockbrokers primarily deal with traditional financial instruments like stocks, bonds, and mutual funds, cryptocurrency brokers exclusively deal with digital assets. Cryptocurrency brokers offer access to a wide range of cryptocurrencies, including popular ones like Bitcoin, Ethereum, and Ripple, as well as emerging altcoins. They also provide services like wallet management, ICO participation, and cryptocurrency custody. Stockbrokers, on the other hand, focus on traditional investment vehicles and may offer additional services like retirement planning and estate management.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago

Related Tags

Hot Questions

- 98

What are the tax implications of using cryptocurrency?

- 95

Are there any special tax rules for crypto investors?

- 66

How can I protect my digital assets from hackers?

- 60

What are the best practices for reporting cryptocurrency on my taxes?

- 46

What are the advantages of using cryptocurrency for online transactions?

- 36

How does cryptocurrency affect my tax return?

- 31

What are the best digital currencies to invest in right now?

- 27

What is the future of blockchain technology?