How does dual class stock affect the valuation of cryptocurrency companies?

Can you explain how the presence of dual class stock impacts the valuation of cryptocurrency companies? How does it affect their market value and investor perception?

3 answers

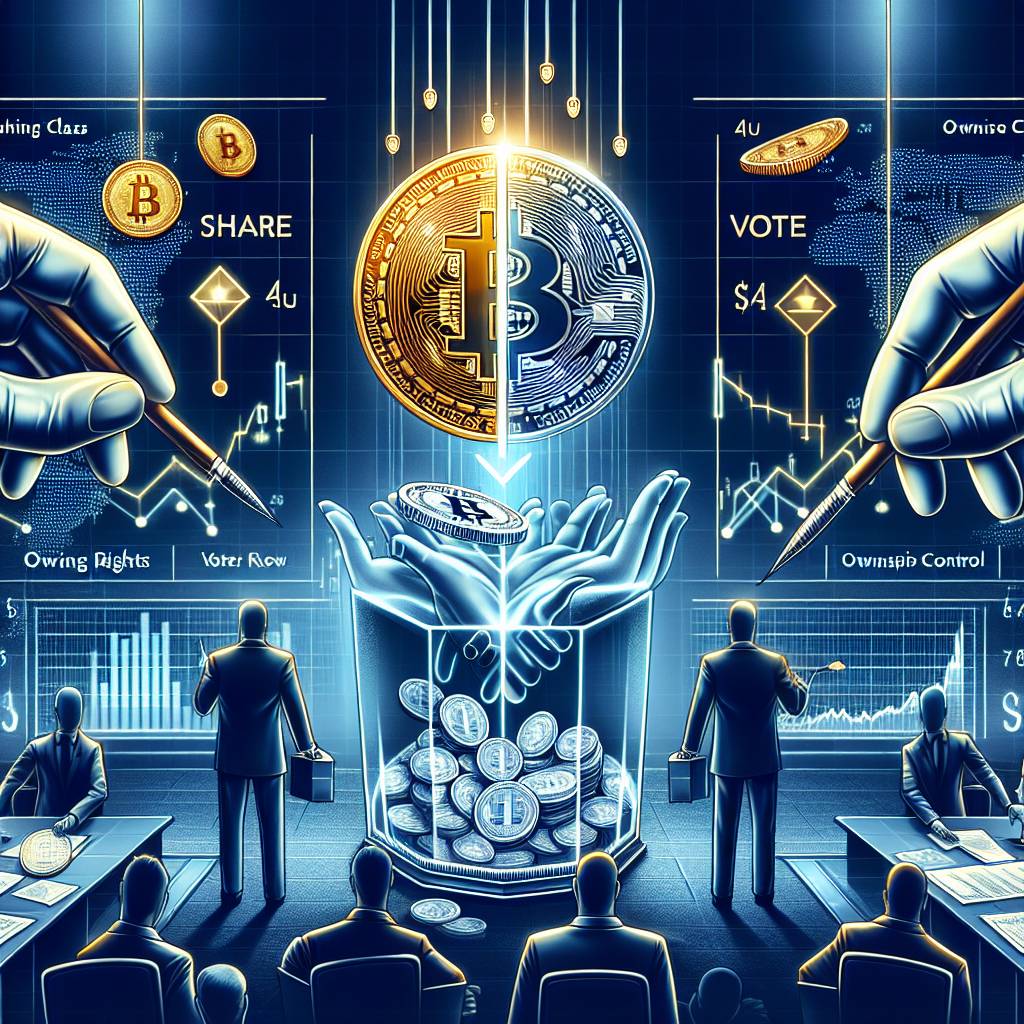

- Dual class stock can have a significant impact on the valuation of cryptocurrency companies. By giving certain shareholders more voting power and control over the company, it can create a disparity in decision-making and governance. This can lead to concerns among investors about the company's long-term prospects and stability, which may result in a lower valuation. Additionally, the presence of dual class stock can also deter certain institutional investors who prioritize equal voting rights. Overall, the valuation of cryptocurrency companies with dual class stock may be influenced by factors such as investor perception, corporate governance, and the potential for conflicts of interest.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago - When it comes to the valuation of cryptocurrency companies, dual class stock can be a double-edged sword. On one hand, it can provide founders and key stakeholders with the ability to maintain control and make long-term strategic decisions without interference from short-term-focused investors. This stability and control can be seen as a positive factor by some investors, potentially leading to a higher valuation. On the other hand, the presence of dual class stock can also create concerns about corporate governance and the potential for abuse of power. These concerns can negatively impact investor sentiment and result in a lower valuation. Ultimately, the impact of dual class stock on the valuation of cryptocurrency companies depends on various factors, including investor preferences and the company's track record of responsible governance.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago - At BYDFi, we believe that the presence of dual class stock can have both positive and negative effects on the valuation of cryptocurrency companies. On one hand, it allows founders and key stakeholders to maintain control and focus on long-term growth strategies, which can be attractive to certain investors. On the other hand, it may raise concerns about corporate governance and the potential for abuse of power, which can impact investor sentiment and valuation. It is important for companies with dual class stock to be transparent and accountable to their shareholders to mitigate these concerns. Ultimately, the valuation of cryptocurrency companies with dual class stock will be influenced by a combination of factors, including investor perception, market conditions, and the company's ability to deliver on its promises.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago

Related Tags

Hot Questions

- 91

How can I minimize my tax liability when dealing with cryptocurrencies?

- 90

How does cryptocurrency affect my tax return?

- 81

Are there any special tax rules for crypto investors?

- 72

What are the best practices for reporting cryptocurrency on my taxes?

- 57

What are the tax implications of using cryptocurrency?

- 57

What are the advantages of using cryptocurrency for online transactions?

- 53

What is the future of blockchain technology?

- 41

How can I buy Bitcoin with a credit card?