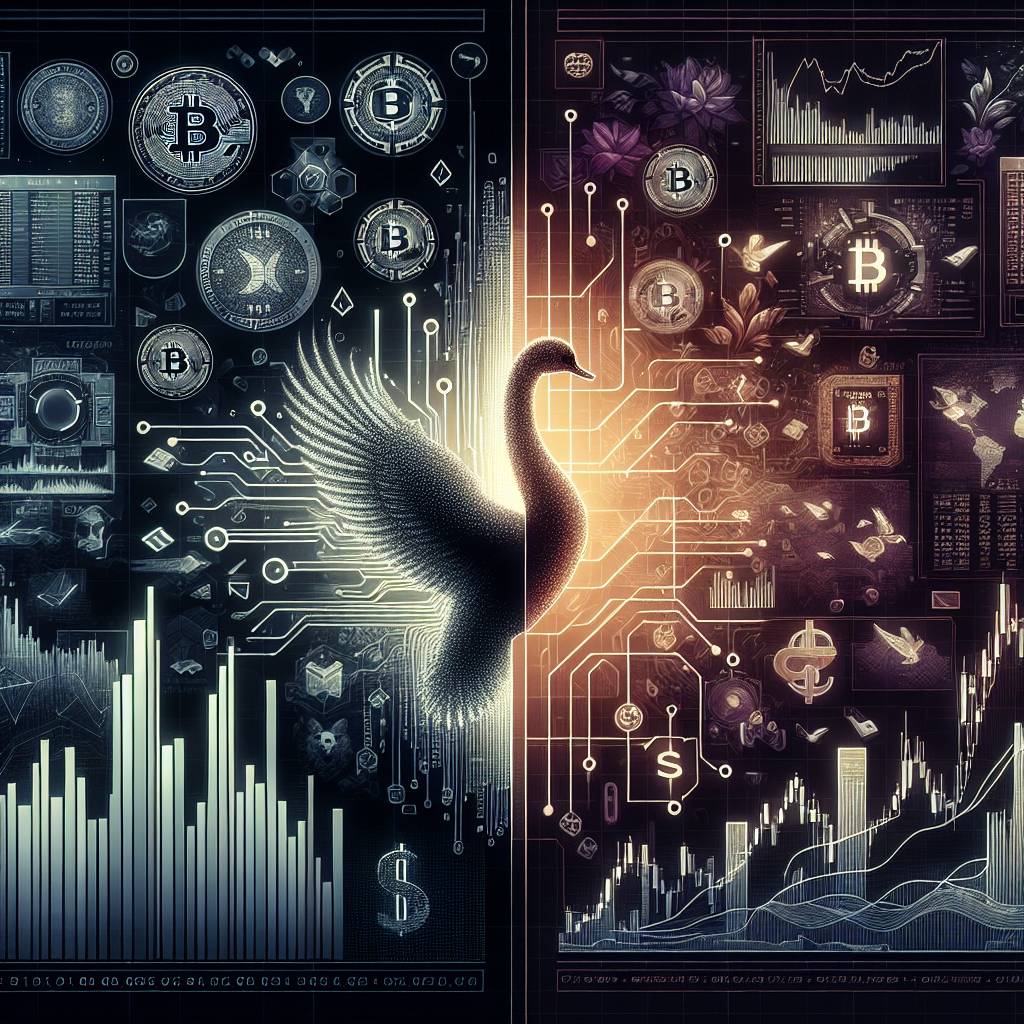

How can investors protect themselves from a black swan event in the cryptocurrency market?

What strategies can investors employ to safeguard their investments in the cryptocurrency market and minimize the impact of a potential black swan event?

3 answers

- Investors can diversify their cryptocurrency portfolio by investing in a range of different coins and tokens. This helps spread the risk and reduces the impact of a single black swan event on their overall investment. Additionally, investors should stay informed about the latest news and developments in the cryptocurrency market to identify any potential warning signs of a black swan event. They can also set stop-loss orders to automatically sell their assets if the market experiences a sudden and significant downturn. Finally, it's important for investors to have a long-term perspective and not panic sell during periods of market volatility, as black swan events are often followed by a recovery.

Nov 25, 2021 · 3 years ago

Nov 25, 2021 · 3 years ago - Protecting oneself from a black swan event in the cryptocurrency market requires a combination of caution and proactive measures. One strategy is to invest only what you can afford to lose, as the cryptocurrency market is highly volatile and unpredictable. Another approach is to conduct thorough research and due diligence before investing in any specific cryptocurrency, assessing its fundamentals, team, and market potential. Additionally, investors can consider hedging their cryptocurrency investments by allocating a portion of their portfolio to more stable assets, such as traditional stocks or bonds. Finally, staying updated with the latest market trends and being prepared to adapt one's investment strategy accordingly can help mitigate the risks associated with black swan events.

Nov 25, 2021 · 3 years ago

Nov 25, 2021 · 3 years ago - While no investment is completely immune to black swan events, there are steps investors can take to protect themselves in the cryptocurrency market. One approach is to use risk management tools offered by reputable cryptocurrency exchanges. These tools allow investors to set up automatic alerts for significant price movements or market volatility, enabling them to make informed decisions and take appropriate action. Additionally, investors can consider using options or futures contracts to hedge their positions and limit potential losses in the event of a black swan event. It's also crucial to stay updated with the latest security practices and protect one's cryptocurrency holdings by using secure wallets and following best practices for online security. Finally, diversifying investments across different asset classes and not putting all eggs in one basket can help mitigate the impact of a black swan event on an investor's overall portfolio.

Nov 25, 2021 · 3 years ago

Nov 25, 2021 · 3 years ago

Related Tags

Hot Questions

- 97

What is the future of blockchain technology?

- 90

How can I minimize my tax liability when dealing with cryptocurrencies?

- 66

What are the advantages of using cryptocurrency for online transactions?

- 56

How does cryptocurrency affect my tax return?

- 50

What are the tax implications of using cryptocurrency?

- 48

Are there any special tax rules for crypto investors?

- 40

How can I buy Bitcoin with a credit card?

- 24

What are the best practices for reporting cryptocurrency on my taxes?