How can I use level 2 data to make better trading decisions in the cryptocurrency market?

Can you provide some insights on how to effectively utilize level 2 data for making informed trading decisions in the cryptocurrency market? I'm interested in understanding the practical applications of level 2 data and how it can help improve my trading strategies. Any tips or best practices would be greatly appreciated!

3 answers

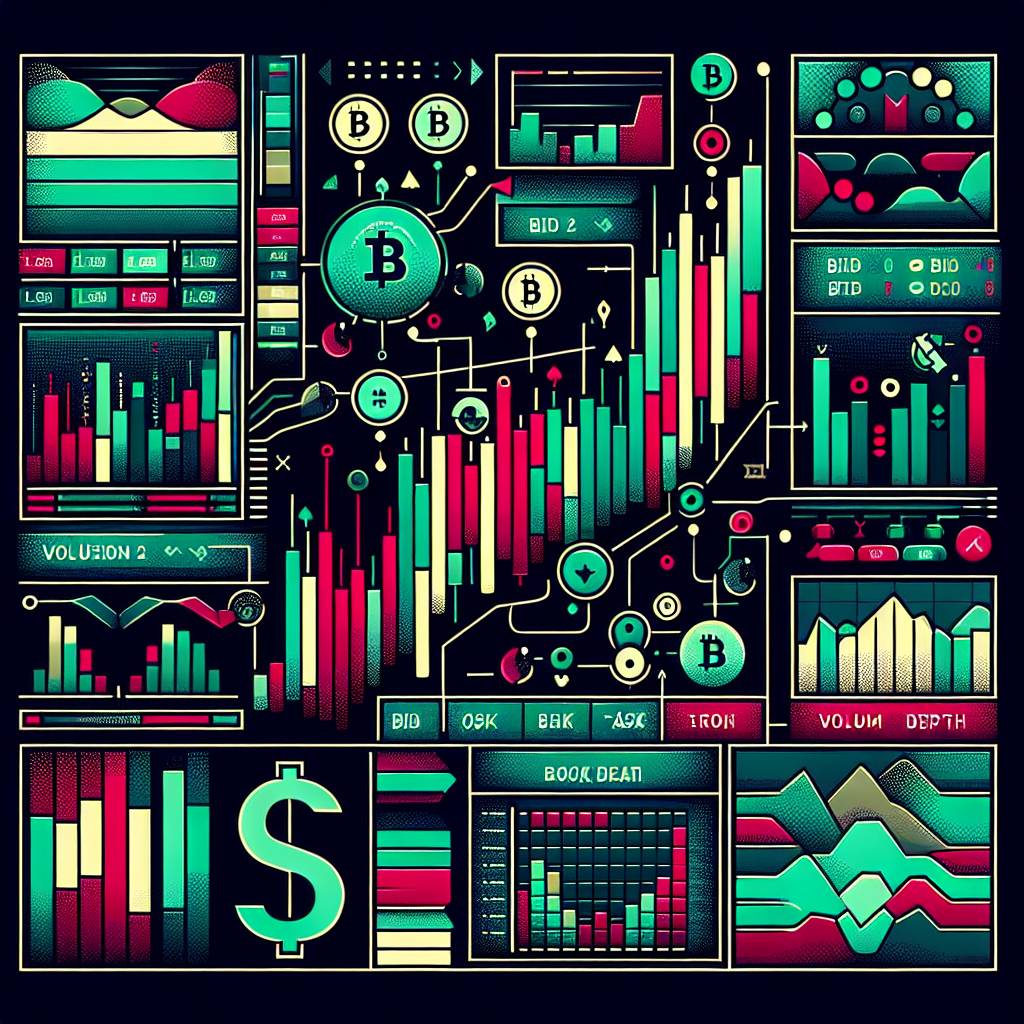

- Level 2 data is a powerful tool that can provide you with a deeper understanding of the order book and market depth. By analyzing the real-time buy and sell orders, you can gain insights into the supply and demand dynamics of a particular cryptocurrency. This information can help you identify potential support and resistance levels, as well as detect any significant buying or selling pressure. By incorporating level 2 data into your trading analysis, you can make more informed decisions and potentially improve your profitability. Remember to combine level 2 data with other technical and fundamental analysis techniques for a comprehensive trading strategy.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - Using level 2 data can give you a better understanding of the market sentiment and liquidity of a cryptocurrency. By monitoring the order book, you can see the current bid and ask prices, as well as the volume of orders at each price level. This information can help you gauge the strength of the market and identify potential entry and exit points. However, it's important to note that level 2 data should not be the sole basis for your trading decisions. It should be used in conjunction with other indicators and analysis methods to validate your trading ideas and reduce the risk of false signals.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - As an expert in the cryptocurrency market, I can tell you that level 2 data is a valuable resource for traders. It provides a detailed view of the market depth and allows you to see the pending orders beyond the top bid and ask prices. This information can be used to identify potential areas of support and resistance, as well as detect any large buy or sell walls that may impact the price movement. By analyzing level 2 data, you can gain a competitive edge in the market and make more informed trading decisions. However, it's important to note that level 2 data is just one tool in your trading arsenal. It should be used in combination with other analysis techniques to increase your chances of success.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago

Related Tags

Hot Questions

- 98

Are there any special tax rules for crypto investors?

- 98

How can I minimize my tax liability when dealing with cryptocurrencies?

- 86

What is the future of blockchain technology?

- 57

What are the tax implications of using cryptocurrency?

- 53

How does cryptocurrency affect my tax return?

- 22

What are the advantages of using cryptocurrency for online transactions?

- 18

How can I buy Bitcoin with a credit card?

- 17

What are the best practices for reporting cryptocurrency on my taxes?