How can I leverage level 2 market data to make better trading decisions in the world of digital currencies?

I'm interested in using level 2 market data to improve my trading decisions in the digital currency world. Can you provide some insights on how I can leverage this data effectively? What are the key factors to consider when analyzing level 2 market data? How can I use this information to make more informed trading decisions?

3 answers

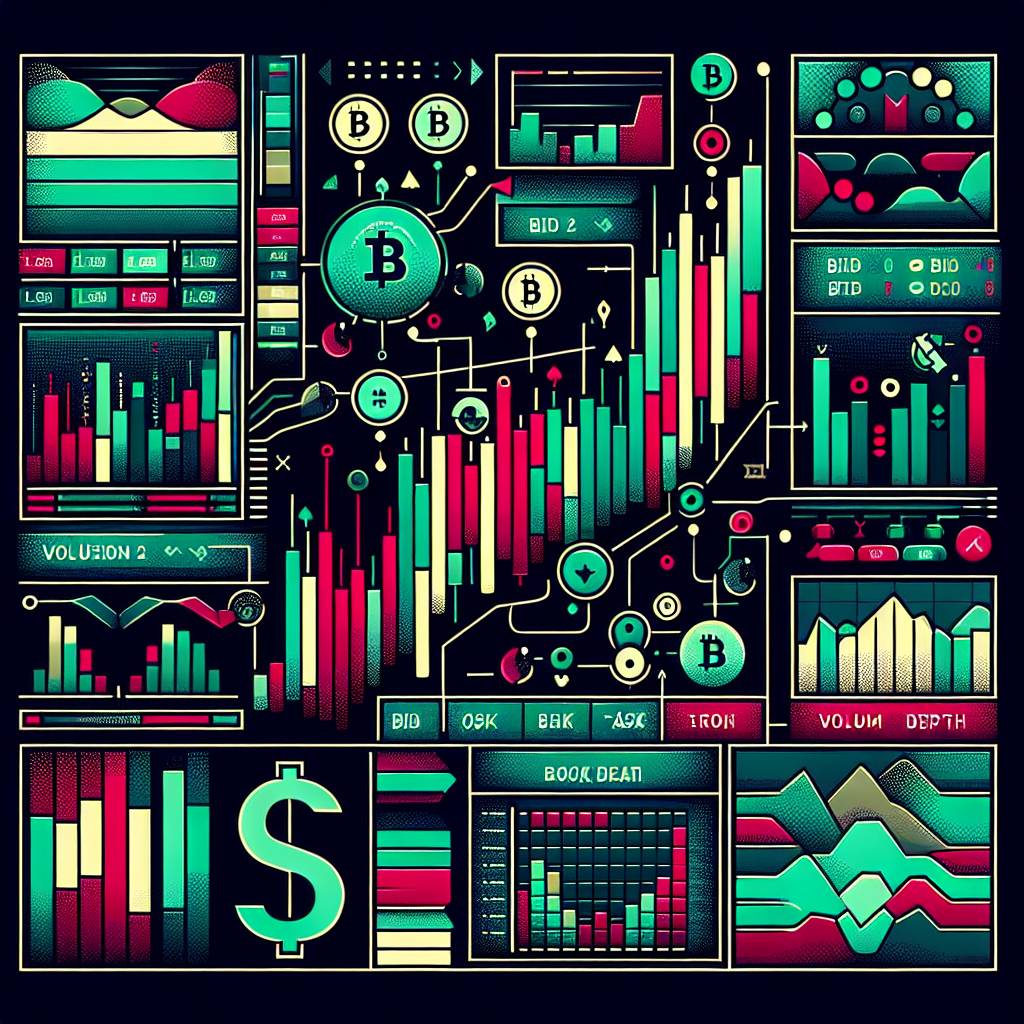

- Analyzing level 2 market data can be a powerful tool for digital currency traders. By understanding the order book depth and liquidity, you can gain insights into the supply and demand dynamics of a particular cryptocurrency. This information can help you identify potential support and resistance levels, as well as detect buying or selling pressure. Additionally, monitoring the order flow can provide valuable information about market sentiment and potential price movements. To effectively leverage level 2 market data, it's important to have a solid understanding of the underlying market structure and the specific characteristics of each cryptocurrency. By combining this data with technical analysis and fundamental research, you can make more informed trading decisions.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago - Leveraging level 2 market data in the world of digital currencies can give you a competitive edge in your trading strategies. By analyzing the depth of the order book and the volume of buy and sell orders, you can gauge the market sentiment and potential price movements. This data can help you identify areas of support and resistance, as well as detect potential market manipulation. However, it's important to remember that level 2 market data is just one piece of the puzzle. It should be used in conjunction with other indicators and analysis techniques to make well-rounded trading decisions. Additionally, staying updated with the latest news and developments in the digital currency space can further enhance your trading strategies.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago - Using level 2 market data to make better trading decisions in the world of digital currencies is a strategy employed by many professional traders. By analyzing the order book depth, you can identify areas of strong support or resistance, which can be useful for setting entry and exit points. Additionally, monitoring the order flow can provide insights into market sentiment and potential price movements. However, it's important to note that level 2 market data is not a crystal ball and should be used in conjunction with other analysis techniques. At BYDFi, we provide our users with access to level 2 market data and a range of other tools to help them make more informed trading decisions. Remember to always do your own research and consider your risk tolerance before making any trading decisions.

Nov 28, 2021 · 3 years ago

Nov 28, 2021 · 3 years ago

Related Tags

Hot Questions

- 84

What are the best practices for reporting cryptocurrency on my taxes?

- 68

How can I minimize my tax liability when dealing with cryptocurrencies?

- 65

What are the best digital currencies to invest in right now?

- 63

What are the tax implications of using cryptocurrency?

- 55

How does cryptocurrency affect my tax return?

- 50

How can I protect my digital assets from hackers?

- 42

How can I buy Bitcoin with a credit card?

- 42

What are the advantages of using cryptocurrency for online transactions?