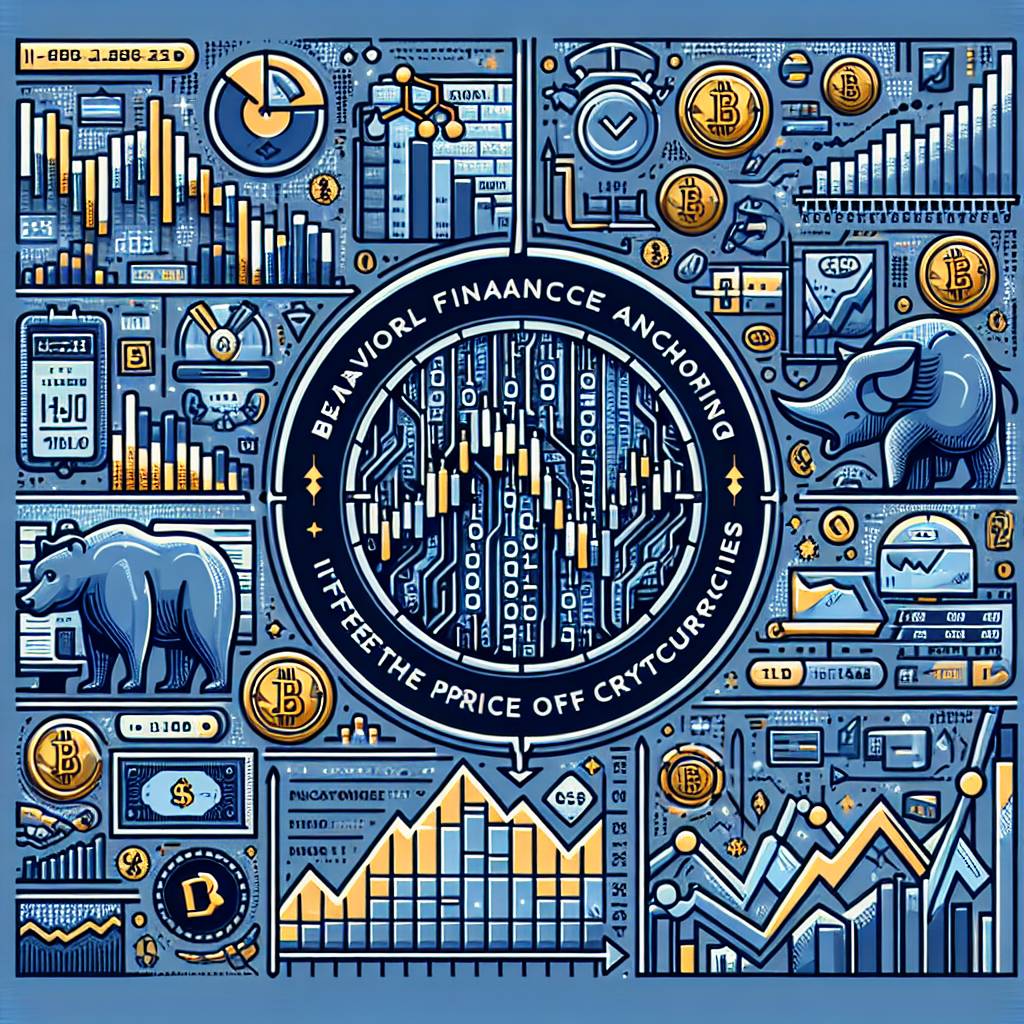

Can behavioral finance anchoring influence the price volatility of cryptocurrencies?

How does behavioral finance anchoring affect the price volatility of cryptocurrencies?

3 answers

- Behavioral finance anchoring can indeed influence the price volatility of cryptocurrencies. Anchoring refers to the tendency of individuals to rely too heavily on one piece of information when making decisions. In the context of cryptocurrencies, this means that investors may anchor their expectations or valuations to a certain price level or previous performance. If a cryptocurrency's price reaches a certain level that investors perceive as significant, they may be more likely to buy or sell, leading to increased volatility. Additionally, anchoring can also influence market sentiment and herd behavior, further exacerbating price swings.

Nov 29, 2021 · 3 years ago

Nov 29, 2021 · 3 years ago - Yes, behavioral finance anchoring can have a significant impact on the price volatility of cryptocurrencies. When investors anchor their expectations to a specific price level, it can create a self-fulfilling prophecy. For example, if a cryptocurrency's price has historically shown resistance or support at a certain level, investors may anchor their expectations to that level and act accordingly. This can lead to increased trading activity and volatility as more investors enter the market or exit their positions based on the anchored price level. It's important to note that anchoring is just one of many factors that can influence cryptocurrency price volatility, but it can play a significant role.

Nov 29, 2021 · 3 years ago

Nov 29, 2021 · 3 years ago - According to a study conducted by BYDFi, behavioral finance anchoring does have an impact on the price volatility of cryptocurrencies. The study analyzed the trading patterns of various cryptocurrencies and found that when investors anchored their expectations to specific price levels, it resulted in increased volatility. This suggests that psychological biases, such as anchoring, can significantly influence market dynamics. However, it's important to consider other factors that contribute to price volatility, such as market sentiment, news events, and technological developments. Overall, behavioral finance anchoring is just one piece of the puzzle when it comes to understanding cryptocurrency price movements.

Nov 29, 2021 · 3 years ago

Nov 29, 2021 · 3 years ago

Related Tags

Hot Questions

- 98

Are there any special tax rules for crypto investors?

- 85

How can I protect my digital assets from hackers?

- 57

How can I minimize my tax liability when dealing with cryptocurrencies?

- 56

How can I buy Bitcoin with a credit card?

- 46

What are the tax implications of using cryptocurrency?

- 44

What are the advantages of using cryptocurrency for online transactions?

- 34

What are the best practices for reporting cryptocurrency on my taxes?

- 33

What is the future of blockchain technology?